7 year interest only mortgage calculator

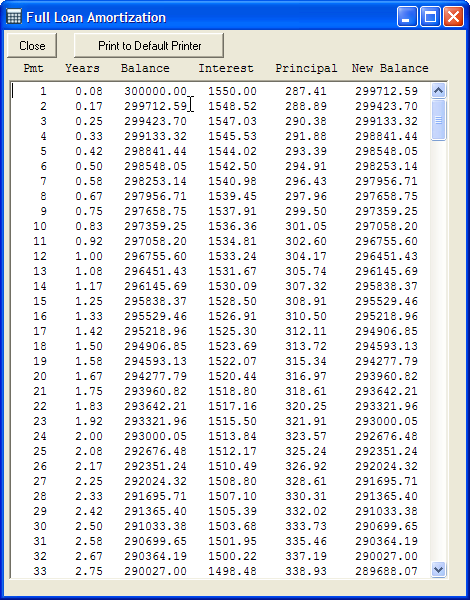

A secured debt is one in which you sign an instrument such as a mortgage deed of trust or land contract that. A fully amortizing 15-year payment an interest-only payment and a specified minimum payment.

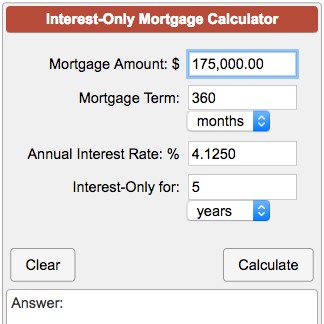

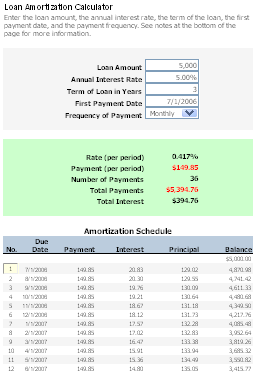

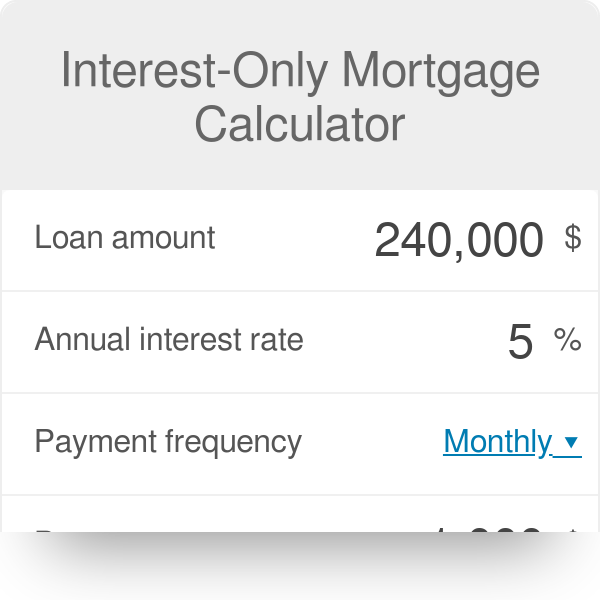

Interest Only Mortgage Calculator

This incurs 391165 in interest costs.

. A 15-year mortgage will have a higher monthly payment but a lower interest rate than a 30-year mortgage. SmartAssets award-winning calculator can help you determine exactly how much you need to save to retire. Start by listing all of your debts except for your mortgage.

So the longer you take to pay off. 32387 more than a 30-year PI loan Scenario 3. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

If you dont know the mortgage rate the calculator has three example rates that you can use. Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score. Enter the current monthly payment amount principal and interest portion only.

This is because of compounding lenders add the interest on your mortgage to the principal so it collects further interest. The interest rate remains the same for the life of the loan. These are the average mortgage rates for 2 3 and 5-year fixed rate.

Next its time to pay off the cars the credit cards and the student loans. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. This equates to 27 percent of the 7 percent rate on the loan.

With the tax deduction the effective mortgage rate is 511 percent. Is a 30-year fixed-rate mortgage right for you. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

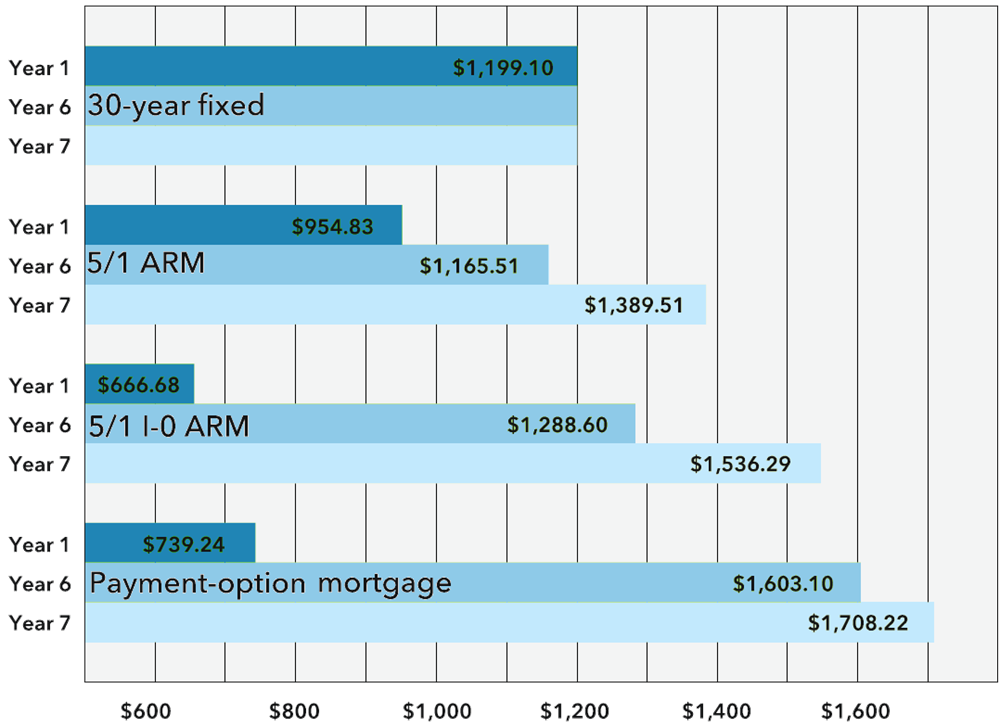

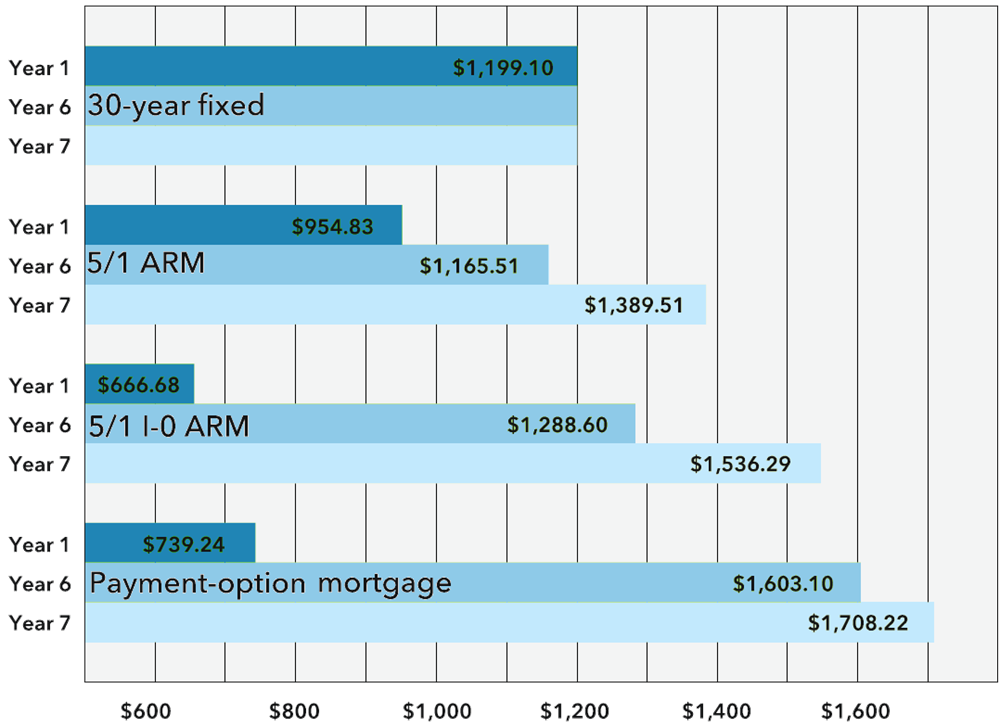

When borrowers consistently make pay-option payments below the accured interest the loan becomes negative amortizing with the loan balance growing over time. The payment rises because interest rates are rising and because. She refinanced the debt in 1993 with a new 30-year.

The mortgage interest deductibility limit was also lowered from the interest on 1 million in debt to the interest on 750000 in debt. Mortgage loan basics Basic concepts and legal regulation. Mortgage Calculator Simple PITI - Mortgage Calculation.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. The mortgage was a 7-year balloon note and the entire balance on the note was due in 1993. Often the standards for an.

A home loan designed to be paid over a term of 15 years. Enter the mortgages annual interest rate. 3 interest over 25 years works out cheaper than 27 over 35 years for instance.

Qualifying for interest-only loans is much harder than qualifying for a normal qualified mortgage like a more traditional 30-year mortgage he explains. Offer applies to New Business Home Loan Mortgage Rates only excludes 4 Year Fixed Home Loan New Business Rates. Enter the original loan term in number of years whole years only.

On a 30-year loan with a 7 percent interest rate the government pitches in 189 percent of the cost of interest through the tax deduction. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgageIf you prefer predictable steady monthly. You can deduct your home mortgage interest only if your mortgage is a secured debt.

51 Arm Mortgage Rates. Building a Safety Buffer by Making Extra Payments. A mortgage in itself is not a debt it is the lenders security for a debt.

Mortgages originated before 2018 will remain grandfathered into the older limit mortgage refinancing of homes which had the old limit will also retain the old limit on the new refi loan. The average 30-year fixed mortgage interest rate is 611 which is an increase of 13 basis points from one week ago. Attack that one with a vengeance.

This incurs 426568 in interest cost. Your principal payments would be amortized over the remaining 25 years of the loan term rather than all 30 years. Pay minimum payments on everything but the little one.

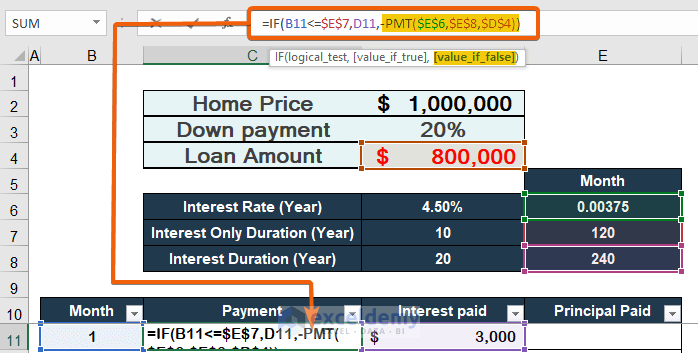

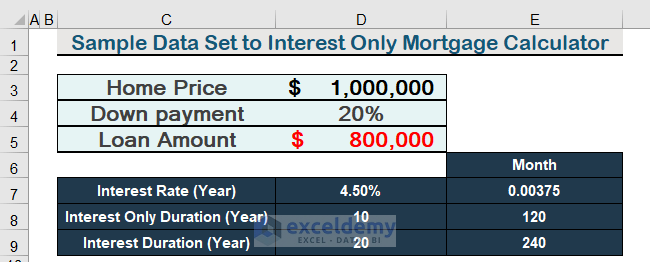

You take a 10-year interest-only mortgage which turns into a 20-year PI mortgage. 71 Arm Mortgage Rates. With our Retirement Interest Only Mortgage calculator you can find out how much you could be eligible to borrow in just a few minutes.

In essence youre pushing the bulk. Under this scenario youd only have to save about 75 of your income. Toggle menu MENU Open24.

Put them in order by balance from smallest to largestregardless of interest rate. Most option ARM contracts. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Your interest rate is typically represented as an annual percentage of your remaining loan balance. Interest-Only Mortgage Calculator. A Retirement Interest Only Mortgage is available to people over 55 and is a loan secured against the value of your home.

A basis point is equivalent to 001 Thirty-year fixed mortgages are the. 7 Year Fixed Rate New Business - less than or equal to 60 LTV. Calculator Rates 7YR Adjustable Rate Mortgage Calculator.

When you have a mortgage on your home the interest rate is the ongoing amount you pay to finance your home purchase. You take a 5-year interest-only mortgage which turns into a 25-year PI mortgage which you then pay off over that time. For example a 4 interest rate on a 200000 mortgage balance would add around 652 to your monthly payment.

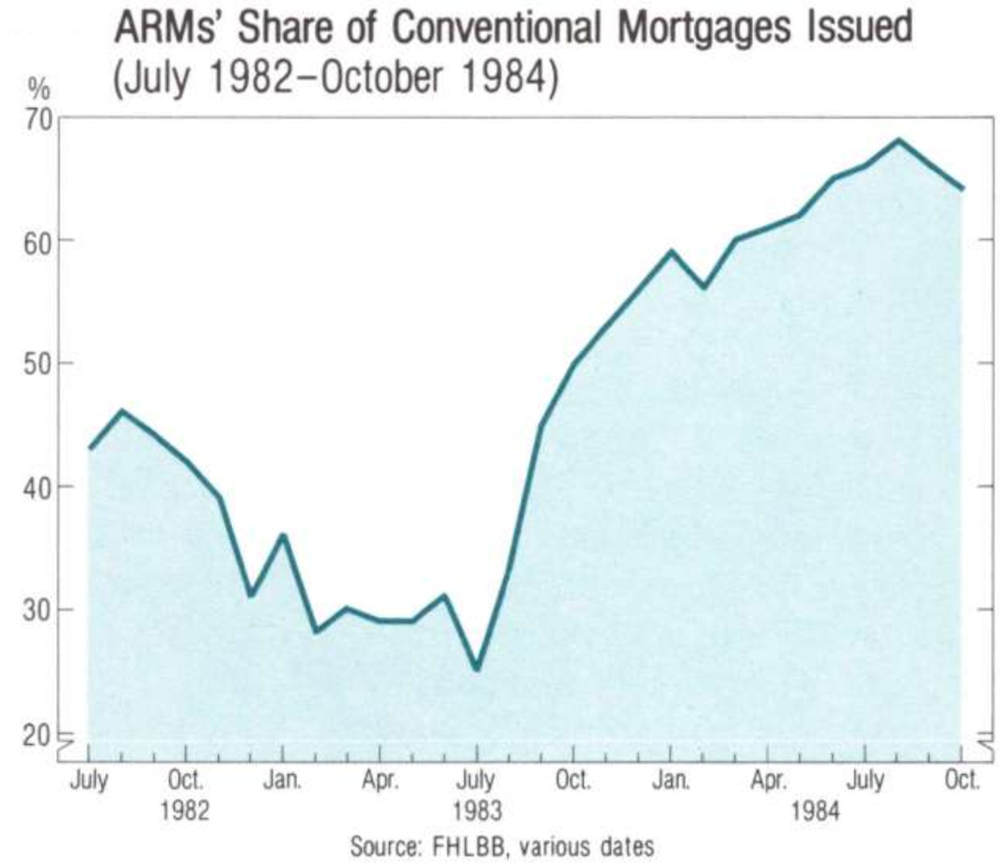

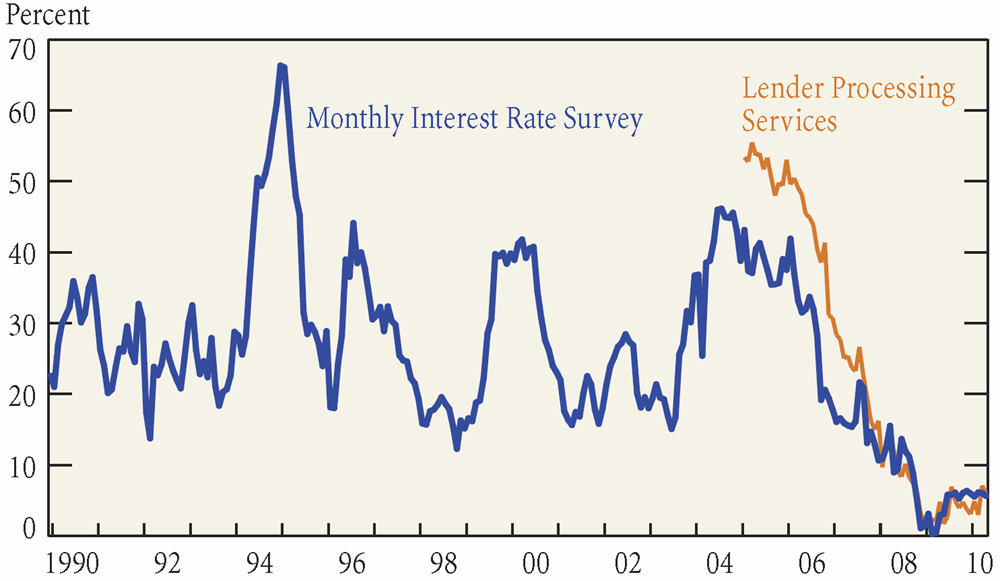

Lets say you take out a 30-year interest-only mortgage with an initial 5-year interest-only period. Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Because you pay more toward the principal amount each month youll build equity in your home faster be out of debt.

51 interest-only ARM--The monthly payment stays at 960 for 5 years but increases to 1204 in year 6. And think your budget will be a bit trimmer than it is today. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

Mortgage Qualifying Calculator. View our up to date mortgage interest rates. Fixed-rate 5-year interest-only mortgage--The monthly payment stays at 1035 for the first 5 years and then increases to 1261 in year 6 as you begin to pay down the principal.

The mortgage interest rate.

Interest Only Calculator

Interest Only Loan Calculator Simple Easy To Use

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Interest Only Loan Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Free Loan Amortization Calculator For Car And Mortgage

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

Interest Only Arm Calculator Estimate 2 1 3 1 5 1 7 1 10 1 Io Monthly Mortgage Payments

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Interest Only Calculator

Interest Only Mortgage Calculator